PESHAWAR -- Pakistani tax authorities are amending rules to monitor jewellers and realtors as part of efforts to curb terror financing and money laundering.

The Federal Board of Revenue (FBR) November 8 issued a draft amendment to the Income Tax Rules 2002 for the monitoring and documentation of realtors and jewellers.

The draft requires approval by the federal cabinet to become law. The government has not disclosed the cabinet's schedule for addressing the draft.

The move is part of an effort to meet the requirements of the Financial Action Task Force (FATF) so that Pakistan can avoid being placed on the global anti-corruption body's blacklist for money laundering and terror financing.

Under the change, designated persons -- jewellers and real estate agents -- would be required to document and record transactions over a certain value.

For jewellers, such transactions include the sale and purchase of precious items, gold, diamonds, platinum, pearls and semi-precious items exceeding Rs. 1 million ($6,450) in value.

Real estate agents would have to record transactions involving immovable property worth more than Rs. 2 million ($12,900).

The documentation for the transactions must include full documents of the buyers and sellers, including Computerised National Identity Cards (CNICs), National Identity Cards for Overseas Pakistanis (NICOPs), Alien Registration Cards, Pakistan Origin Cards and copies of passports or documents of legal stay.

Both jewellers and realtors would have to maintain records of their dealings and report any suspicious transactions in the FBR's Iris online tax return system.

Teams of tax officials would have the power to inspect the records of jewellers and realtors and cancel their licences in case of any ambiguity.

"Now, it will be possible to compile the records of business owners who are undocumented and are vulnerable" to pressure or blackmail by criminals, said Deputy Commissioner Headquarters Regional Income Tax Office Peshawar Mohsin Khan.

"The introduction of automation to maintain the records of taxpayers will also help ... [us] monitor and analyse records," he said.

"The easiest way to hide tainted money has been to invest in real estate and purchase gold and other precious stones that can be sold unnoticed and easily," Khan said.

'Duty of each and every person'

Such deals are often undocumented, increasing the chance that the funds involved could be used in unlawful activities, including terror financing, according to Khan.

"The new system will monitor the black market economy, close all loopholes and address the concerns of the FATF besides strengthening the economy of the country and improving its stature in the community of nations," he said.

"It is the duty of each and every person to support the government in its efforts to eliminate the occurrence of money laundering and terror financing," said Haji Muhammad Yousaf, who owns a shop in Sarafa Bazaar, the jewellery market of Peshawar.

"The evil of terror is totally dependent on resources to flourish, and we, as community members, must cut its lifeline," he said.

Another factor that must be kept in mind while increasing the government's monitoring of jewellers and property agents is their level of awareness of the significance and future implications of the whole exercise, Yousaf said.

"They should be given orientation and guidance to co-ordinate with and support tax authorities in achieving the objective of curbing terror financing and money laundering," he said. "The proposed amendments will yield desired results if business owners are taken on board and if we enact trust-building measures."

"Assurances on the part of the government to protect the identity of the designated person will affect the productivity of the tax amendment initiative," said Muhammad Zia, a property agent operating in Hayatabad.

"The safety of the designated person who informed authorities of any objectionable transaction must be considered, and his [or her] identity must be protected," he said.

Money laundering and terror financing are the concern of every person who wants peace in his or her motherland, he said.

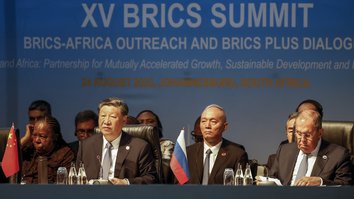

![The Sarafa Bazaar, the jewellers' market of Peshawar, is shown in November. Pakistani tax authorities have proposed draft amendments requiring jewellers and realtors to report any suspicious transactions. [Muhammad Shakil]](/cnmi_pf/images/2019/12/05/21210-img_1586-585_329.jpg)