PESHAWAR -- A much improved security situation in Khyber Pakhtunkhwa (KP) has bolstered the confidence of commercial banks, leading to an increase in lending in the restive province.

A decade-long wave of terrorism kept banks hesitant to provide loans to businessmen in KP.

However, with the return of normality and a reduction in the number of terror incidents, commercial banks no longer consider KP a "red zone," say bankers.

Banks have ended an informal moratorium on lending to KP clients, one that dated back to 2009, said Zargham Khan Durrani, head of Retail Banking-North of the Muslim Commercial Bank (MCB).

"In 2009, the situation was chaotic in KP because of the peak of militancy, and the risk factor [prevented] banks from lending to businessmen," he told Pakistan Forward.

But with a visible improvement in law and order, MCB is now fully facilitating KP businesses by considering requests for loans with little hesitation, he said.

Increasing loans, cash advances

The MCB is providing about Rs. 10 billion ($100 million) in advances, an amount much greater than the deposits the bank is receiving from the region, Durrani said.

Advances are funds provided by banks to businesses to fulfill a working capital requirement that are to be repaid within one year.

"The National Bank of Pakistan (NBP) has recently approved advances to the tune of Rs. 1 billion ($10 million) in KP, while about Rs. 20 billion ($200 million) in loans is in the pipeline," NBP Executive Vice President Khurram Saeed Naik told Pakistan Forward.

To facilitate the processing of advance requests, NBP's executives have authorised regional heads to make decisions at their own discretion, ensuring quick processing and documentation, Naik said.

Farukh Zaman, regional manager of Soneri Bank, said his company "is fully facilitating businessmen in KP and does not consider the region a 'red zone'."

"Our bank is extending its branches in KP, and recently we set up offices in Swabi and Mardan districts," he told Pakistan Forward, adding that the bank's policy is to provide customers with equal facilities across the country.

Facilitating business, economic growth

KP's economy has suffered from KP being "a frontline province in Pakistan's ongoing war against terrorism", said Asad Shah, chief manager of the State Bank of Pakistan (SBP) Rawalpindi office.

Shah made his remarks November 24 at a meeting of SBP's Local Credit Advisory Committee held at the Sarhad Chamber of Commerce and Industry (SCCI) in Peshawar.

Speaking to the CEOs of several commercial banks, Shah stressed that the situation has improved in KP and that monetary institutions should facilitate the province's business community.

"The perception of fear has gone now, and it is time to [contribute to the] development of the country in general and KP in particular," he said.

While banks are infusing more funds into the KP economy, some policies need updating, stakeholders say.

"The lending policy adopted by commercial banks in the wake of the bad law and order situation in KP has hampered industrial growth in the province," SCCI President Zahid Shinwari said during the November 24 meeting.

The industrial and agriculture sectors and small- and medium-size enterprises in KP have all suffered because of their inability to borrow from banks, he said.

The advance-to-deposit ratio is very low in KP, according to Shinwari, meaning that banks take in more money than they lend.

"Things are improving in KP," he said. "We have positive economic indicators due to the return of peace, and it is now up to the banks to come up and play a role in the development of the province by facilitating businessmen."

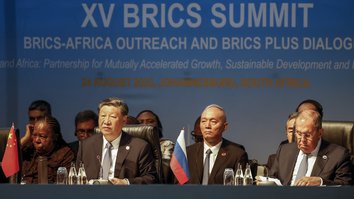

![Zahid Shinwari (second right), president of the Sarhad Chamber of Commerce and Industry (SCCI), speaks at a Peshawar meeting with KP businessmen and bankers November 24. [SCCI]](/cnmi_pf/images/2017/12/19/10721-dsc_0193-585_329.jpg)