ISLAMABAD -- The recent planned merger of anti-terrorism and money-laundering laws by the Pakistani government will be a big step in curbing terrorism and its financing, analysts say.

Prime Minister Imran Khan chaired a meeting of senior government officials March 13 to discuss measures to prevent money laundering, Dawn News reported.

Minister for Law Farogh Naseem briefed attendees on the current Anti-Money Laundering Act and the Anti-Terrorism Act of 1997, and participants decided to merge the laws.

Their proposal soon goes to parliament, where passage is considered a formality.

The move is aimed at charging suspects under one law, making it easier to link the two crimes.

The participants also discussed proposed amendments that would declare money laundering a cognisable and non-bailable offence and would increase the maximum imprisonment to 10 years and the fine to Rs. 5 million ($35,790) for those convicted of such charges.

Money launderers "are the nation's enemies," Khan said. "Such elements deserve no leniency."

Preventing terror financing

"We need to merge both the laws as money laundering has been the main revenue source for acts of terrorism," Peshawar-based lawyer Noor Alam Khan told Pakistan Forward. "The Paris-based Financial Action Task Force (FATF) has been urging Pakistan to take measures to stop money laundering."

Pakistan needs to curb money laundering as many of the funds transferred help finance acts of terrorism, he said. "Pakistan is required to take measures to stop money transfers through illegal channels and to combat terror financing as demanded by FATF."

"Following the 9/11 incident in the United States, there has been a worldwide consensus that money transferred through non-banking channels finances terrorism," Khan said.

"Since then, many countries have passed laws to check financial transactions and to control terrorism," said Khan.

Once Pakistan merges the two laws, it will have new restrictions on the transfer of money, he added.

"It would enable the country to establish a data bank on legitimate senders of money through banks, and those involved in hundi and hawala would come under the law," Khan said, adding the move will help the government ramp up economic reforms, prevent tax evasion and boost trade.

Bringing perpetrators to justice

The merger of the two laws will prove useful in stopping money laundering and the financing of terrorism, agreed Peshawar-based legal scholar Shah Nawaz Khan.

"Different law enforcement agencies will be strengthened as they will take advantage of the proposed legislation to bring to justice the perpetrators of terrorism and money laundering," he told Pakistan Forward.

Apart from the merger of the two laws, Pakistan should bolster the efforts of the Financial Monitoring Unit of the State Bank of Pakistan, National Counter Terrorism Authority, Federal Investigation Agency and Federal Board of Revenue to prevent illegal money transfers, Abdur Rehman, a political scientist at Abdul Wali Khan University Mardan, told Pakistan Forward.

"If these departments work actively, we can hope to stop the menace of money laundering, and the country will see not only a reduction of terrorism but of foreign debt too," he said.

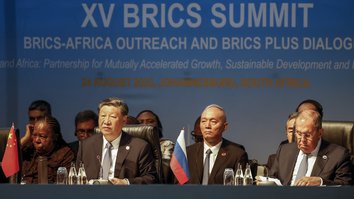

![Peshawar residents pass by a money exchange shop March 21. [Ashfaq Yusufzai]](/cnmi_pf/images/2019/03/27/17239-money-585_329.jpg)