KARACHI -- Pakistan is cracking down on terrorism financing through a new anti-money laundering data tracking centre.

The State Bank of Pakistan (SBP) established the new centre within its Financial Monitoring Unit (FMU) in collaboration with the United Nations Office on Drugs and Crime (UNODC) and the United Kingdom's Department for International Development (DFID).

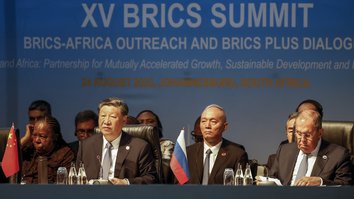

SBP Governor Ashraf Wathra, the United Kingdom High Commissioner in Pakistan Thomas Drew and the UNODC Representative in Pakistan Cesar Guedes inaugurated the new centre in Karachi on February 10.

The SBP's data tracking centre installed the UNODC's specialised software aimed at countering terrorist financing and money laundering called goAML.

The software automatically detects and reports suspicious financial transactions related to these crimes, SBP said in statement.

Previously, analysis of the data reported by the FMU was carried out manually, which was slow and vulnerable to oversights, it said.

"Now, the customised software and high precision equipment installed in the new data centre will allow the financial monitoring unit to analyse suspicious transactions and currency transactions in a more robust, sophisticated and automated manner," the SBP statement said.

Moreover, it will enable the FMU to disseminate financial intelligence to the relevant law enforcement agencies in a more efficient manner.

Discouraging illegal financial transactions

"This is a good initiative of the SBP that is part of Pakistan's on-going efforts of discouraging money laundering and terrorism financing for the past many years," said Dr. Ashfaque Hasan Khan, economist and dean of the school of social sciences and humanities at the National University of Sciences and Technology in Islamabad.

However, the new tracking centre only monitors official financial transactions related to banks, he said. It does not monitor the traditional hundi system, which runs parallel to the banking system.

"We must keep in mind that money laundering and terror financing are mostly carried out through the hundi or hawala systems," he told Pakistan Forward.

In addition to enhancing the monitoring of the banking system, efforts should also be made to eliminate the decades old hundi system, he said.

Khan also suggested that the SBP realign its policy to tighten control on the currency exchange rate to curb the unnecessary gap in inter-bank and open market rates.

If the exchange rate of the dollar and other currencies against the Pakistani rupee increases by more than Rs. 2, it would encourage inflows of foreign exchange through the hundi system, he explained.

Improving monitoring through technology

"Manual monitoring of money laundering and terrorism financing through banks did not yield the desired results in the past," said Muhammad Arif, editor of The Financial Daily in Karachi and former director of the SBP's Financial Markets Strategy and Conduct Department.

"That's why the SBP has acquired modern software with the support of the UNODC and DFID."

The new data centre will empower the SBP and domestic banks to detect suspicious transactions that will then be investigated for further action, he said.

"In the past, Pakistan's banking system did not have a fool-proof system to monitor money laundering and financing of terrorism, but the new data centre will make the banks safe from such unwanted banking," he told Pakistan Forward.

The SBP and domestic banks should co-operate to create awareness about the new data centre and to train relevant bank staff to detect and analyse transactions related to money laundering and terrorism financing, he said.

He also urged the government to crack down on the individuals behind the unlawful hundi and hawala systems.

Promoting legal money transfers

"The National Bank of Pakistan (NBP) has already undertaken various initiatives in recent months to promote remittances and to discourage the hawala system," said NBP Vice President Syed Ibne Hassan.

The new data centre will motivate Pakistanis at home and abroad to send money through legal channels and desist from using the systems that cover up money laundering and terrorism financing, he said.

"Now, with the new tracking system, the SBP and other domestic banks will certainly join hands to promote the use of the official banking system to transfer legal money and discourage all kinds of unlawful transactions," he told Pakistan Forward.

![State Bank of Pakistan Governor Muhammad Ashraf Wathra (right) and United Kingdom High Commissioner in Pakistan Thomas Drew inaugurated the bank's new high-tech data tracking centre in Karachi on February 10. The bank is cracking down on financial transactions related to money laundering and terrorism financing through an automated process utilising software created by the United Nations Office on Drugs and Crime (UNODC). [Javed Mahmood]](/cnmi_pf/images/2017/02/17/7257-launching_of_data_tracking_center-585_329.jpg)